Managing the Reduction in R&D Tax Credits for UK Businesses

The Chancellor's plans to reduce R&D tax credits have been met with a lot of opposition from business heads. It is expected that the small business R&D tax relief will be lowered from 130% to 86% in April and the SME credit rate will be reduced from 14.5% to 10%. This has created additional pressure on UK companies that depend on this relief as they are presently challenged by a variety of issues such as increasing interest rates, a corporation tax raise for all but the smallest corporations and a challenging fundraising atmosphere.

In the UK, numerous small companies are dependent on tax credits to keep creating cutting-edge technology and to draw in trained personnel. Since a significant majority of R&D requests are submitted under the SME scheme, reducing these rates will have a detrimental effect on a great many enterprises. Consequently, businesses will have to reconsider their cash flow planning and look for alternative sources of finance, including taking on debt or offering shares to investors.

Businesses must be aware that HMRC has started to rigidly enforce R&D claims. It is advisable to anticipate that small companies' claims may be challenged or refused as HMRC investigations become more frequent. People managing these investigations are seen as an obstacle to SMEs and have been denying more claims than usual. There is proof that HMRC is not adhering to its own internal rules when denying claims.

The industry has reacted with considerable criticism to the proposed alterations. Start-up firms in the early stages of their development often bring the most innovation to the table, but the current circumstances may be too much for these businesses to bear as they strive to secure funding. Consequently, their future is uncertain.

A comparison of debt and equity financing

A comparison of two forms of financing, debt and equity, can be a useful way to determine which option is best for a particular situation. Debt is a form of financing that involves borrowing money from a lender to be repaid with interest over a set period of time. Equity, on the other hand, is a form of ownership in a business that gives the investor a share of the profits and losses in the business.

Despite the fact that the cuts are making it less desirable for SMEs to pursue R&D, there are still other choices available.

Prior to beginning to solicit funds, companies need to analyze their cash flow management and planning first. Doing regular projections can assist in discovering probable deficits and underline significant parts to reduce non-essential outlays. Executing a sensitivity analysis will demonstrate how alterations in elements such as costs per unit could impact profits. It's also a good idea to maintain a positive rapport with the firm's shareholders in case there is any bad news. When there are established plans for the short term, businesses can begin to evaluate obtaining financing.

Fast-growth businesses often choose to take equity funding, as it motivates the stakeholders to work towards the success of the company. Small and medium-sized enterprises that would like to pursue this option should look into the Enterprise Investment Scheme (EIS). Although it has become more complex in recent times and equity finance tends to be pricey, EIS gives investors tax reliefs if they purchase new shares in a business.

In the early stages of the business, taking on less debt is essential. Yet, with economic downturn predicted, investors are becoming more hesitant to commit and it is probable that the next investment round will be at a lower price.

For those looking for a more economical way to obtain additional funds, debt financing can be an attractive option. With debt financing, businesses can acquire money without sacrificing any ownership equity. Nevertheless, it can be difficult for those who are just beginning, have little financial history, or are operating in industries deemed to be high-risk.

Clients have indicated that they will move their research & development activities and corporate operations to other locations that offer a more beneficial environment. As the energy support scheme is set to be concluded in March, the government must take steps to provide substitute advantages for startups.

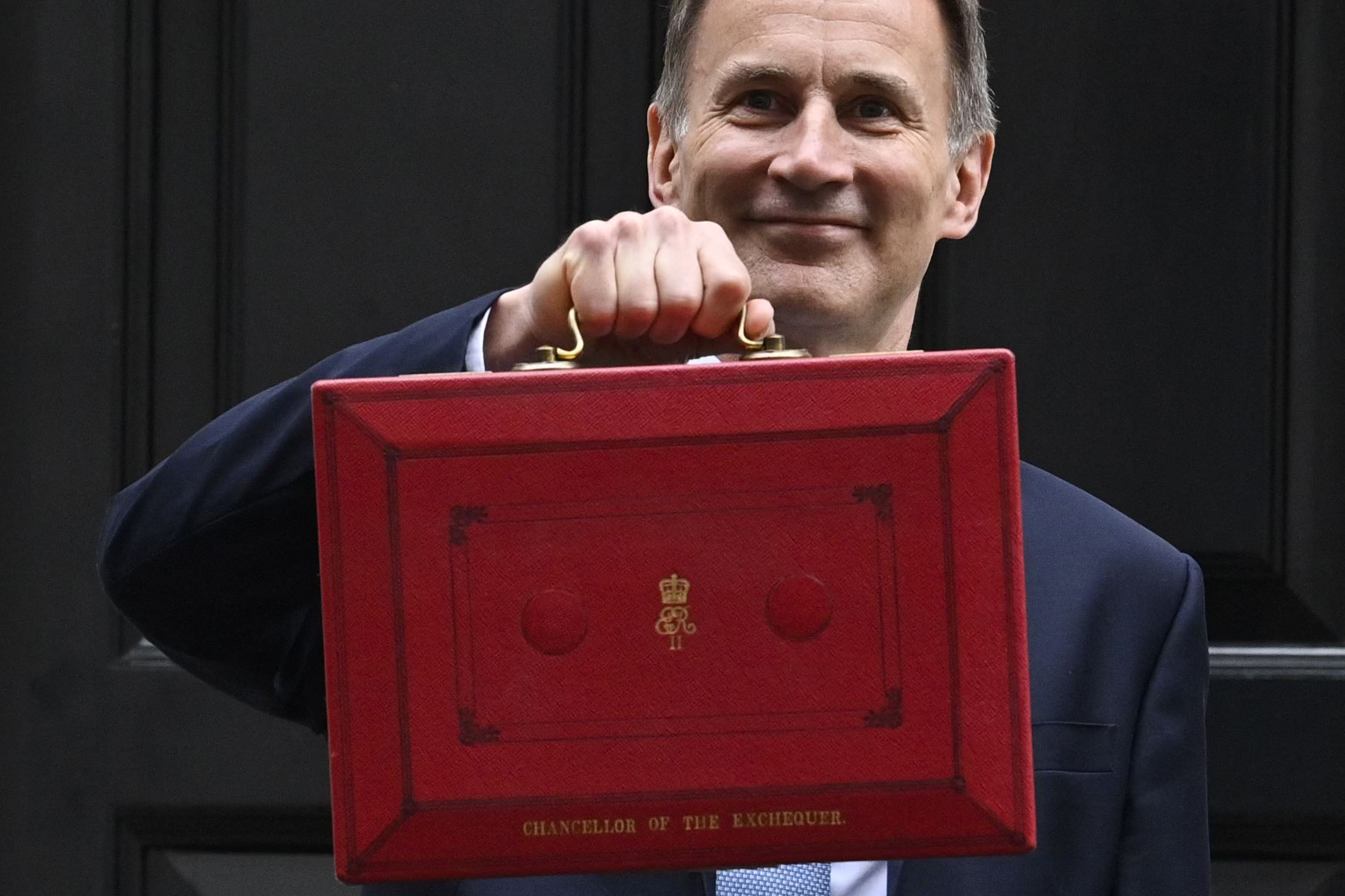

The upcoming budget is anticipated to be intriguing. Reports of policy reversals and reductions in taxes have been circulating, yet if the government keeps on with the current plans, it will be necessary to provide another incentive for SMEs to invest in R&D. For instance, other financing choices such as the EIS plan could profit from simplifying a number of the complexities that have been incorporated over the past 10 years. It would also be interesting to observe green policies take higher precedence, such as escalated incentives for energy storage or subsidies for house insulation.

The House of Lords Economic Affairs Committee recently released a report suggesting that HMRC can help reduce the potential for fraud and error in claims by improving the assistance it provides to businesses. This could include better communication to improve businesses' understanding of the scheme and an expansion of the Advanced Assurance process for SMEs.

The criteria for the R&D scheme becoming more stringent is expected to discourage businesses and investors from setting up in the UK, thus undermining the government's intention to make the UK a science and tech leader. Those that are determined to stay afloat should take into account external influences such as the increased interest rates, which are currently the highest since the financial crisis.

The outlook for the near future is unsettling, so to make the transition smoother it's important to analyze current cash flow models and have a thorough understanding of the potential modifications and the effects they could have. This is a requirement for businesses to maintain stability.