Autumn Budget of 2022 and what it means for companies accessing R&D Tax Credits

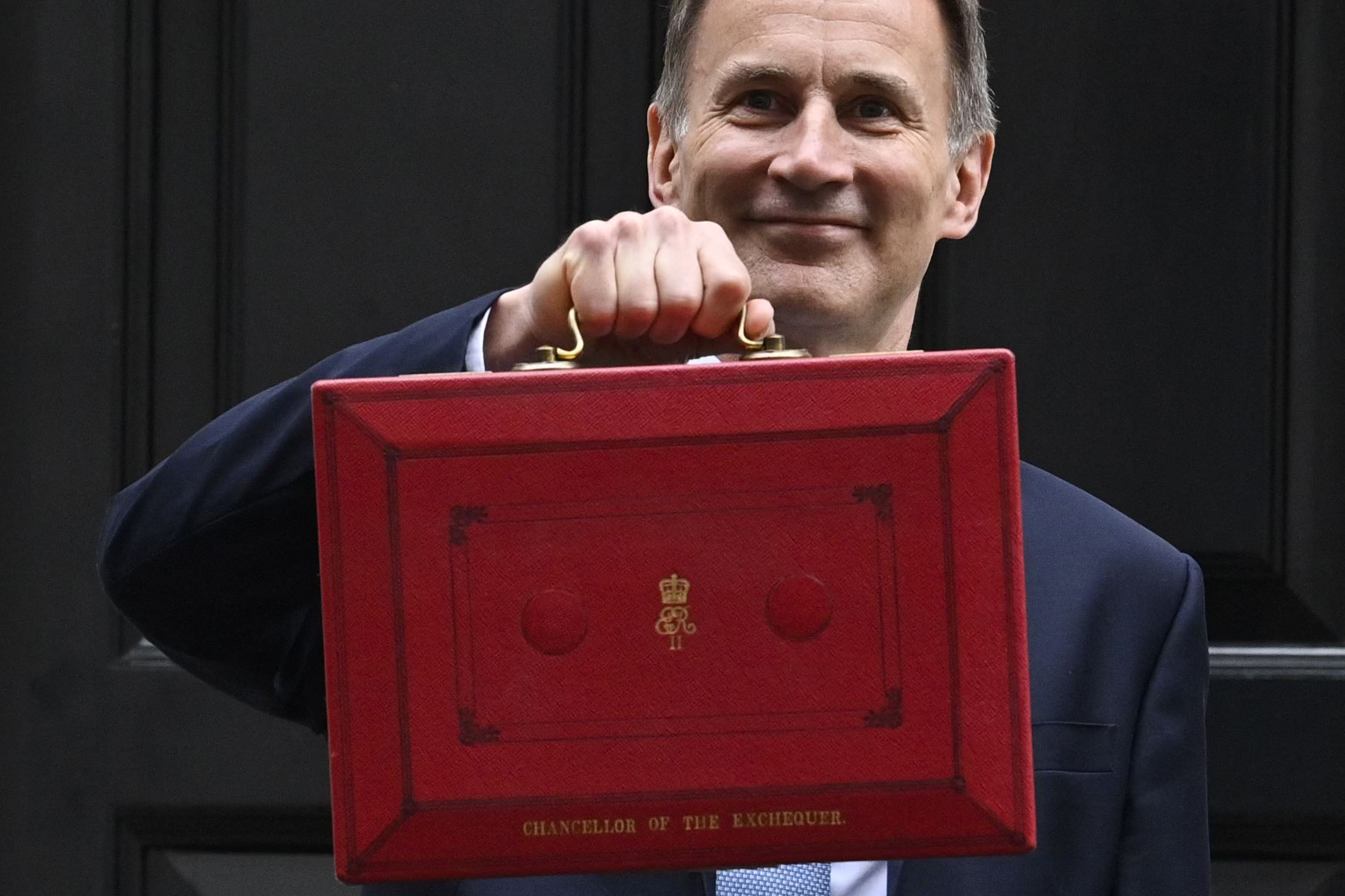

As part of his Autumn Statement, Jeremy Hunt placed a high priority on the preservation and expansion of stability. Several new measures were implemented in order to curtail inflation and overcome unprecedented global obstacles. Major adjustments were also made to R&D tax relief rates.

Since the overall economic outlook has deteriorated, media coverage has been dominated by tax increases and spending cuts aimed to enhance the country's finances. As part of the reform of R&D tax relief, meticulous consideration was given to the rebalancing of rates within the incentive in an effort to ensure that taxpayers' money is spent as efficiently as possible.

Generous increases in the Research and Development Expenditure Credit (RDEC)

By 2024-25, the government is committed to increasing R&D spending to £20 billion annually, representing a cash increase of approximately a third over 2021-22. It is estimated that this is the largest-ever R&D expenditure during a Spending Review.

At first glance, it would seem that this would be favourable news. It is desirable to see a rise in R&D investment, especially in light of our desire to innovate our way out of the recession.

In response to this spending commitment, the Chancellor has announced that RDEC interest rates will surge.

It is anticipated that the Research and Development Expenditure Credit (RDEC) rate will increase from 13% to 20% from 1 April 2023 onwards.

These changes will be enacted in the Autumn Finance Bill of 2022 and they will strengthen the effectiveness of taxpayer-funded innovation programs.

As part of its initiative to design a single R&D tax incentive, the government has announced its intention to consult experts. And to better understand the needs of SMEs that focus on R&D, the government has promised to work with the industry before next year's Budget.

In the Autumn Budget 2021, the previous Chancellor affirmed to amend research and development tax reliefs. The reforms will include a refocus on innovation in the UK, targeting abuse, and improving compliance. As part of the Spring Finance Bill of 2023, the suggested changes will be enacted into law. A sub-committee of the Lords' Economic Affairs Committee is currently investigating these measures under the auspices of the Finance Bill Sub-Committee.

How this affects companies accessing RDEC

It is estimated that a 20% increase in RDEC rates would result in a 42% increase in generosity (after tax) from 10.5% to 15%.

Hopefully, this will alleviate the impact of the looming change in overseas R&D relief, limiting the damage for multinational companies suffering from a shortage of skilled workers in their domestic markets.

Based on the econometric model used by HMRC in its evaluation of RDEC in October 2020, RDEC is calculated as having an exceptional potential than the other two schemes. Accordingly, it provides a greater return on taxpayers' money and may explain the Chancellor's decision to 'rebalance' the relief in favour of RDEC.

Therefore, increasing RDEC's generosity is likely to result in a marked increase in business investment in R&D, which will assist the government's growth strategy.

Additionally, RDEC's additionality ratio advantage over SME rates is anticipated to continue to make the UK a desirable investment destination.

In addition to simplifying the relief process, RDEC provides increased certainty and visibility, enabling better business decisions.

Reduced generosity of R&D tax relief for SMEs

It appears that the Chancellor's rebalancing act has not brought any positive news to small companies claiming the SME R&D tax credit.

In an effort to improve compliance, reduce fraud and errors, and increase the efficacy of relief in general, relief for SMEs has been greatly scaled back. As announced by the Chancellor, the enhancement rate for SMEs will be decreased from 130% to 86% and the credit rate from 14.5% to 10%. A typical loss-making SME can currently claim a credit of up to 33% on eligible R&D expenditures. In accordance with the announcement made today, the generosity of this credit will be reduced by 44% to 19% effective 1 April 2023.

Therefore, a business that makes an SME claim that includes £500,000 of qualifying expenditure will now receive a payable credit of £93,000, as opposed to £166,750 previously.

Effect on investment in R&D by SMEs

As a consequence of these figures, smaller innovative SMEs may face a slowdown in their R&D investments, posing a threat to their growth and jobs.

As a result of the previously announced increase in corporation tax to 25% for businesses with profits over £250,000, the decline in generosity is more pronounced for smaller businesses, both loss-makers and businesses with smaller profits. Consequently, smaller businesses will be affected by the changes, including immensely innovative start-ups that have yet to achieve revenue, which contradicts the Chancellor's suggestion that "those with more should contribute more."

The Chancellor cites error and fraud as the reason for the changes, but it is not evident how precisely this measure targets these issues. According to HMRC's estimates, 7.3% of errors and fraud are committed in the SME scheme (whereas the RDEC estimates 1.1%).

Further funding to assist HMRC in assigning additional staff to tackle fraud and error is welcome, but further transparency regarding the proportions of error and fraud within the relief program is essential in order to fully comprehend the scale of the problem and evaluate future measures.

How will these changes impact innovative companies?

Based on the Office for Budget Responsibility's (OBR) analysis, the Chancellor's Autumn Statement measures will not negatively affect investment in research and development.

This change will contribute to fiscal sustainability by increasing revenue and reducing fraud and error without materially changing R&D expenditure levels over the forecast period, according to the government.

However, the changes to the SME rate will be most detrimental to the smallest companies, and R&D-intensive high-tech start-ups may feel unfairly affected at a time when protecting and growing investment in research and development is a specifically challenging task.

Furthermore, introducing a further set of changes will increase complexity for all businesses seeking relief, and the lack of certainty will adversely affect investment decisions.

In reality, there were very few levers that could be pulled by the Chancellor to address the UK's growth problem. This is a positive sign that the government intends to increase R&D spending on a long-term basis. However, UK R&D spending as a percentage of GDP lingers mid-table internationally, falling behind OECD competitors.

Adopting a modern definition of R&D - one that reflects the remarkable advances made by UK innovators - would be a long way toward closing this gap, providing greater returns for UK corporations.

The good news is that he expresses straightforward support for R&D tax incentives, demonstrating the mainstream view that R&D tax credits are crucial to innovation ecology and economic growth.